Nestle is a food and drink-producing and processing Swiss multinational conglomerate corporation. Henri Nestle established the food and drink company in 1866. Today, we’ll discuss the BCG matrix of Nestle; it will focus on four growth market share quadrants; stars, cash cows, question marks, and dogs.

We are updating our website at a massive scale, editing 1000s of pages and blogs; we’ll include the latest details, figures, and statistics here in the introduction section in a while.

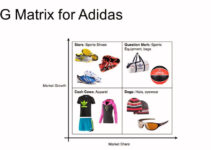

The BCG matrix of Nestle would analyze the four growth market share quadrants like stars, cash cows, dogs, and question marks. Here’s the Nestle BCG matrix growth share analysis as follows;

BCG Matrix of Nestle

Let’s discuss the four growth market share quadrants in the BCG matrix of Nestle as follows;

Stars of Nestle

The star quadrant in the Nestle BCG matrix growth share analysis comprises such products and services of the company that have higher market share and higher growth rate. They contribute significantly to the sales, revenue, and profitability of the food and beverage company. However, some of the main star products and services of the company Nestle are as follows;

I-Nestle Mineral Water

According to an estimate, Nestle generated roundabout 4.5 billion CHF in the US and Canada; and 8 billion CHF globally during the period of 2019-2020. The food and drink brand has a higher market share and higher growth rate in the mineral water category. Some of the bottled water subsidiary brands of Nestle are as follows;

- Vittle

- S. Pellegrino

- Perrier

II-Nescafe Coffee

According to an estimate, the market share of Nescafe coffee in 2021 was 22% and it generated roundabout 22.4 billion CHF the same year. Nescafe coffee has earned a significant market share and growing consistently. Some of the top coffee brands of Nestle are as follows;

- OOH Coffee 10%

- RTD Coffee 4%

- R&G Coffee 5%

- Coffee Creamer 10%

- Instant Coffee 31%

- Portion Coffee 41%

Cash Cows of Nestle

The cash cow quadrant in Nestle BCG matrix growth share analysis consists of highly mature products and services that have higher market share and limited growth rate. They play a key role in sales and profitability and help the company to cover its expenses. However, some of the cash cow products and services of Nestle are as follows;

I-Maggi Noodles

According to an estimate, Nestle Maggi Noodles has a market share of 60% in the noodles industry. The noodle market has become highly competitive and there are various brands offering similar products, and the competitive environment has stopped Nestle’s growth rate. It is contributing significantly to the company’s revenue and profitability stream.

II-Chocolates

According to an estimate, Nestle’s chocolate sale in 2022 was 6.1 billion Swiss francs. The chocolate market is growing consistently and it will reach roundabout 187.1 billion US dollars by the end of 2027. The reason Nestle’s chocolate segment has a slower growth rate is because of the increasing competition.

III-Flavored Milk

According to an estimate, the market size of Nestle flavored milk is 5.23% and the company’s growth rate is slower. The reason for the slow growth rate of Nestle in the flavored milk category is due to the tough competition from brands like Hershey’s, Danone, and Saputo. In order to stabilize and amplify its market share, Nestle should re-evaluate its strategy.

Question Marks of Nestle

The question mark quadrant in Nestle BCG matrix growth share analysis comprises such products and services that have lower market share and higher growth rate. They have the potential to become the next star products if the company works on them and improves the weak areas. However, some of the question marks of Nestle are as follows;

I-Nutrition Products

According to a statistical report, the market size of Nestle’s health and nutrition products in 2022 was 7.7 billion CHF with a higher growth rate. In order to amplify Nestle’s market share in the health and nutrition product segment, the company fixed the weak area and offered whatever customers were looking for.

II-Confectionaries

According to an estimate, the sale of Nestle confectionary items and products in 2021 was 8.1 billion Swiss francs. The confectionery market has a higher growth rate and high competition. Nestle should introduce new tastes or unique products in the confectionary market to amplify its market share and take advantage of the growth rate.

Dogs of Nestle

The dog quadrant in the Nestle BCG matrix growth share analysis included those products and services that have a lower market share and lower growth rate. Instead of contributing any profit and revenue to the company, the dog products consume a lot of capital resources of the brand. Some of the dog products of Nestle are as follows;

I-Nestle Milo

Nestle product Milo couldn’t win and attract a significant portion of the market share and had a limited growth rate. It is not a contribution to the profit and revenue of the company.

II-Koko Crunch

Koko Crunch is the other product of Nestle that couldn’t win the market share or maintain its growth rate. It is consuming the capital resources of the company.

Conclusion: Nestle BCG Matrix Growth Share Analysis

After an in-depth study of the BCG matrix of Nestle; we have realized that Nestle is the world’s leading food and drink processing corporation. If you are learning about Nestle BCG matrix growth share analysis; then you should keep in mind the abovementioned four growth share quadrants like stars, cash cows, dogs, and question marks.

Ahsan is an accomplished researcher and has a deep insight in worldly life affairs. He goes Live 3 days a week on various social media platforms. Other than research writing, he’s a very interesting person.